What is Eligible Employment for PSLF?

To be eligible for PSLF, Direct Loan borrowers must work full time for an eligible employer. Eligible employers include:

- U.S.-based government (federal, state, local, or tribal), including U.S. military positions.

- Not-for-profit employer that is tax-exempt by the IRS and qualifies as a 501(c)(3).

- Certain not-for-profit employers providing qualifying public services.

- AmeriCorps and Peace Corps Volunteers.

Normally, you must be a direct employee of a qualifying employer; however, if you work in a state that has a law that prevents a qualifying employer from hiring employees directly to fill positions or provide services, an employee of a contractor organization could be an exception. This often occurs in states that have laws where health care facilities are not permitted to hire employees directly, so they contract with physicians’ groups. For more information about contractor positions, please visit the Federal Student Aid website.

Does Your Residency Program Qualify for PSLF?

Qualifying public service positions include work in 501(c)(3) nonprofit organizations, which may include medical schools and teaching hospitals. To verify if your residency program qualifies, check with your Human Resources Department. Many times, program directors are also familiar with PSLF and will be able to tell you if the residency program meets PSLF employer eligibility requirements.

Is Your Employer an Eligible PSLF Employer?

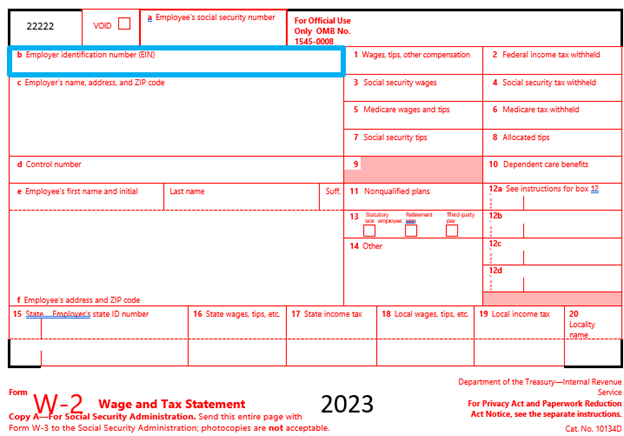

If you have your employer’s Employer Identification Number (EIN) and your employment dates, you can use the PSLF Employer Search Tool to determine if your employer is a qualifying PSLF employer. The EIN can be found on your W-2.